Contents

Introduction

The global financial crisis emerged in the United States in the first half of 2008. Eventually, it spread around the world that evolved it into a systematic phenomenon (Edey, 2009). Even though it transmitted through different channels, it affected all the countries leading them to devise adaptive monetary policies to sustain the situation. Consequently, negative policy rates had been added to the toolboxes by various Central Banks after the conventional easing measures were exhausted. The first one to move the policy rate to a negative territory was the Central Bank of Sweden in 2009, followed by Denmark in 2012. Similarly, the European Central Bank (ECB) introduced its Negative Interest Rate Policy (NIRP) in the June of 2014. This was due to the fact that the ECB Governing Council decided to reduce the ECB’s Deposit Facility Rate (DFR) below 0% for the first time in order to influence the market rates since the global crisis. The same negative rate policy had later been adopted by Switzerland in 2015, and Japan in 2016 (Verick & Islam, 2010).

The fundamental question regarding this involves how the ECB resorted to such policy when its main financing operations rate averaged around 3% between 1999 and 2008. The ECB had been created in the year 1999 and after a span of 13 years, its main refinancing operations rate averaged less than 0.5% (Claeys & Demertzis, 2017). There can be various causes that can be linked to this outcome. Nonetheless, it can be narrowed down to two significant economic crises that the ECB faced in almost a century. Therefore, it had to provide a highly accommodative monetary policy. This is due to the fact that it had to fulfil its price stability mandate. Moreover, interest rates have been observed to decline in the last four decades especially in advanced economies. Thereby, it comes down to central banks to adjust (Hartmann & Smets, 2018).

This report entails the basics of interest rates that is followed by the detailed decoding of negative interest rates. Subsequently, it elaborates on the rationale behind introducing negative interest rate policy by the ECB. It further discusses its impact on the commercial banks and the overall economy.

Analysis

Policy Interest Rate

The policy interest rate is the most essential rate due to the fact that it influences all the other interest rates of the economy. It is the rate at which the Central Bank of a country will pay or charge the commercial banks for the deposits and loans. Therefore, it affects the interest rates that the commercial banks charge their customers. The policy interest rate is set by the Central Bank of a country (Investopedia, 2021).

In general, the commercial banks raise their deposit and borrowing rates whenever there is a rise in the policy interest rate by the Central Bank. Similarly, a decrease is experienced in the vice versa situation. Nonetheless, the changes in the deposit and borrowing rates by the commercial banks may not be same as the changes by the central banks (Investopedia, 2021).

The change in the policy interest rate is not only limited to the impact on the interest rates by the commercial banks but also on the purchasing power and decision of the general public (Friedman & Kuttner, 2010). Therefore, it can be claimed that such changes impact the overall economy of a country. For instance, an increase in policy rate will impact a rise in deposit and borrowing costs for the commercial banks leading to higher interest rates for loans to the businesses and individuals. Consequently, it will decrease the buying power. Moreover, the increase in loans can increase the operations cost for the businesses leading to higher cost of goods and final products resulting in inflation in the market. Similarly, the decrease in policy rates influences a decline in the deposits and borrowing rates. This results in an augmentation of loans taken by the businesses and individuals flowing more money in the economy through an increase in investments and reduction in savings. Therefore, it can be inferred that reduction in interest rates boost the economy due to the fact that lower deposit rates encourage people to invest in high-yielding stocks and real estates. As a consequence, people become wealthier and become more willing to invest and spend impacting the economy of a country in a positive way. Hence, the changes in the policy interest rates can be linked to the law of demand and supply as per the basis of its influence on various aspects of an economy (Li, et al., 2021).

Negative Interest Rate

Negative interest rates are set by the central banks, especially during the deflationary periods. This is done in order to encourage consumers to spend instead of saving (Assenmacher & Krogstrup , 2018). The reason is that the consumers reduce their spendings to a dangerously low levels in hopes of getting more return by investing in the future. Such circumstances lead to a sharp decline in the demand of various goods and services. Nonetheless, only bringing the policy interest rate to zero may not resolve the issue and stimulate growth in the economy. This suggests that the central bank must let go of its monetary policy. Therefore, it can be deemed that such a situation involving zero nominal interest rate may occur. However, commercial banks will have to keep their excess reserves stored at the central bank (Beers, 2021).

Rationale behind NIRP

Since such a situation of central banks imposing negative interest rates had not been unprecedented, there are various examples available as to verify the impacts of negative interest rates imposed by central banks. Nonetheless, there can be both positive and negative impacts of such a policy (Altavilla, et al., 2019). The outcome may be judged on the basis of the domination of one side. The results can depend on various factors including the structural features of the economy, prominence of banks, aversion of households, behavior of general public to the negative interest rates, etc. Therefore, the ultimate outcome can be time and country specific (Altavilla, et al., 2022).

Considering the ECB’s decision of NIRP in 2014, it can be associated with the circumstances of low inflation and declining equilibrium real rate of interest. This is due to the fact that negative interest rates can restore the central bank’s signaling capacity. This effectively removes the zero lower bound (ZLB). It can assist in bringing the real interest rate down to compensate for the prevailing inflation in the market. Furthermore, it helps in flattening the yield curve significantly. Therefore, it can be ascertained that a negative interest rate helps lower real rate, leading to a rise in inflation expectations and augmenting the demand of various goods and services in the economy. However, it may create a widening gap leading to deflation pressure. Hence, cutting down nominal rates and holding excess reserves of the commercial banks, the central banks can lower the interbank and other interest rates in the market. As a consequence, it serves as an encouraging factor for the commercial banks to become more riskier in granting loans and facilitating portfolio rebalancing (Claeys, 2021).

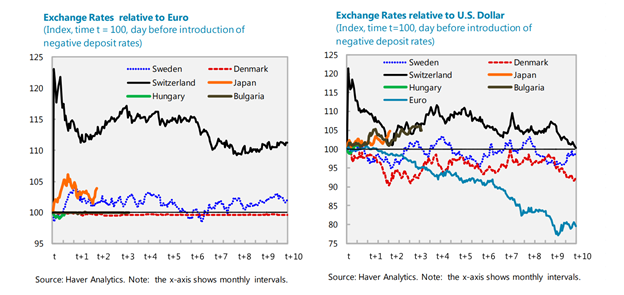

To examine the impact of the NIRP on exchange rates, it would be difficult to do so since there are various factors that influences the external demand. Negative interest rates impact the exchange rates to depreciate through the provision of incentives for transferring the wealth to higher-yield investments. Due to this reason, a widening real term spread differential might erupt putting a downward pressure on the currency of the country. Moreover, there are impacts of the inflation of other countries and their currencies. Furthermore, the stimulative influence of the negative interest rates on demand and inflation might also offset the deprecation (Smith, 2020).

The economic lower bound of NIRP is fundamentally ascertained by the influence that the negative interest rates garner on the financial intermediation. Even though there is a cost pressure for excess liquidity for the banks, a mitigating policy from the central banks limit the incentives for related circumstances. There falls a pressure from banks as well when the rates become more negative (Agarwal & Kimball, 2022). This is due to the fact of their diminishing profitability as it is related to the diminishing deposit rates. This can also create hindrances in terms of trade-offs between effective transmission of money and the profitability of banks. Moreover, the negative policy rates can transmit to lower lending rates. Thereby, this can decline the earnings of commercial banks, even on their previous accounts. Consequently, readjustments to their forecasts of previous lending may become unfruitful for the banks. However, such an issue could be resolved if the negative interest rates are imposed on deposits or the banks substitute more wholesale funding for deposits. Yet, the retail deposit rates are deemed to be downward sticky due to certain reasons. The first being that the households and small businesses do not experience the same set-up costs as the financial institutions in terms of the storage of cash. Furthermore, the zero-interest rate can often act as a psychological threshold. In addition to this, the stickiness of deposit rates impacts the avoidance of the fact that saving may be penalized. Thereby, it is determined by the actual cost of holding cash. Hence, the demand for cash increases mostly for the economic agents who have high excess liquidity. Consequently, the Net Interest Margins (NIMs) of the commercial banks also decline. However, banks may increase their lending rates in such a situation. Nonetheless, this may not be possible if the central banks roll out a policy determining a cap on the lending rates. Under which, it may be difficult to ascertain whether it would be profitable for the banks or not as it varies from bank to bank and their previous accounts and their ability to lend further capital. This may either result in difficulties or postponements by the commercial banks to lend out capital to the businesses and individuals (Jobst & Lin, 2016).

A long period of negative rates can be deemed as a concern in terms of financial stability. In addition to the discussion above regarding the stickiness of deposit rates in such situations, this variable encourages the banks to find substitutes for deposits in less stable wholesale funding. Taking the examples of Germany, Spain, and Italy, where the deposit base is wider as compared to the deposit base of Europe, the trade off market would be more incentivized. Nonetheless, this creates a growing need for the appropriate supervision on the liquidity of banks. Thereby, it can be claimed that the negative interest rates can create ease from the aspects of financial stability, especially for borrowers, but only in the short run. However, it can distort the debt affordability in the long term. This is due to the fact that the situations may lead to pushing the lending rates below zero (CeliaLópez-Penabad, et al., 2022).

Although, the impact of negative interest rates on the overall economy of a country is difficult to ascertain. This is because it is not easy to measure the macro effects of NIRP. The reasons may vary as per their intensity and their further influence on countless other factors. There may be other unconventional measures that may be strenuous to separate from the negative interest rates. The NIRP was only adopted in a few countries that makes the sample not valid enough to determine its affects for the global environment. The selection bias should also be considered here as it may not have been deemed favorable by certain central banks on the basis of cost-benefit analysis. Nonetheless, there are positive impacts of NIRP that have been verified by the countries that implemented it.

Impact

Considering the NIRP and its impacts, the overall financial conditions of the country enhanced to adequate levels of expectations. Central banks of various advanced countries had set such policies at low levels, yet sufficiently enough to not disturb the exchange rates. Moreover, NIRP has been effective in terms of reducing the rates in the money markets and in transmission for lowering the lending rates. This has been beneficial for both organizations and individuals. Even the retail and corporate deposit rates declined that assisted in permitting the commercial banks to maintain their margins of lending and bolstering their credit growth. In circumstances of sticky deposit rates, the banks shifted to fee-based services and augmented the lending to offset the declining effect on their revenues. Therefore, it can be inferred that the negative interest rates in the countries did not impact the exchange rates. This affect can be linked to the disinflationary dynamics of economies in such ways as it prevented real rates from declining a certain point (Palley, 2018).

On account of money market, the rates followed an increasingly negative marginal policy rate with no disruptions towards the market functions. The rate has been observed at or above the marginal policy rate in conditions of excess liquidity. In various countries, a tiered central bank deposit rate had been utilized to make the transmission of marginal policy rate to money markets smooth. This reduced the cost of interbank lending and restored the signaling capacity of central banks. It also made the commitment to maintain low rates for a certain period more reliable for the people. Nonetheless, there are several variables that could have been employed to keep the money market rate exclusive from the deposit rate. These include the amount of excess liquidity and a certain amount to be exempted from the marginal policy rate, the spread for excess reserves between the marginal and average policy rate, and the willingness of banks to engage in interbank lending with excess liquidity (Carbó-Valverde, et al., 2021).

Taking into account the wider economy, the negative policy rate impacted the general public through cuts in lending rates. This made the lending procedures and standards more lenient for both businesses and households. Some countries used this very same impact to reduce the negative influence of the NIRP on lending rates from the perspective of commercial banks. This had been executed through increasing the lending to the firms and individuals yet augmenting the commission fees and other costs for lending. In Denmark and Sweden, the banks kept negative interest rates for large corporations yet positive rates for retailers in the aspects of deposits. In Switzerland, the commercial banks adjusted the lending rates slowly when the negative rate had been announced. This assisted in raising the bank profitability (Khoury & Pal, 2020).

Moreover, the direct cost for excess reserves had been put to modest considering the size of the financial position of the banks. Negative interest rates impact the bank’s cost of holding. Nonetheless, the above strategies prove that the bank’s profitability is less sensitive to negative rates. In addition to this, the banks usually earn negative returns on various liquid assets for the purpose of managing the liquidity risk. In Europe, there had been no unambiguous sign of cash hoardings by people. Thereby, the money still regulated in the economy without much hindrance. In addition to this, the excess reserve situation did not incentivize much to the banks to seek alternative measures for this purpose. Nonetheless, the commercial banks had been hesitant to forward the negative interest rates to the depositors. The large corporations had been excluded from this segment as they had been offered reduction in interest rates on the deposits. This assisted in motivating people from not hoarding cash rather investing it through banks or other means. The augmentation in cash holdings could be associated with the correlation between currency in circulation and movements in the short-term interest rate. This reflected the reduction in opportunity cost of holding cash. Thereby, it had been ascertained that whether the rates had been positive or negative, the currency in circulation increases whenever the interest rates decline. The negative interest rates impacted the yield curve to be flattened yet there had been no direct relation between negative interest rate and reductions in bank profitability (Tokic, 2017).

Conclusion

This report entails the concepts of interest rates, further delving into the circumstances of central banks imposing negative interest rates and how it impacts the economy as a whole. Subsequently, the decision of ECB launching Negative Interest Rate Policy in 2014 due to the global crises had been discussed in detail. It demonstrates the conditions where negative interest rate could be imposed. Furthermore, it distinguishes the whole scenario for this outcome pointing towards the aftermath of the global crisis even on the developed economies. In addition to this, the rational behind this decision has been highlighted discussing the historic trends and the future expectations while considering the recent scenario to emphasize on the need of reducing the policy interest rate to zero percent. Subsequently, the report highlights the impact of this policy not only on the commercial banks but also on the overall economy. As per the previous literature and evidence, it has been evident that negative interest rate is not bad at all. Instead, it has been a better approach to bring back an economy to financial stability. Even though it is said to impact the bank’s profitability in a negative way, there is adequate data to prove otherwise. In such a situation, the commercial banks implemented different strategies to offset this. Nonetheless, it has been ascertained that there is less risk of damage to bank’s profitability by reducing the policy interest rate below zero per cent. Furthermore, the evidence suggests that negative interest rates may have an issue with sticky deposit rates. Nonetheless, the negative rates have proven to reduce the lending costs for businesses and households. Thereby, this provides incentives to the general public to not hoard cash, instead invest in the economy. In the situation foregoing global crisis, the negative interest rate policy helped in soothing the economy by encouraging people to lend and invest more instead of hoarding cash. Although negative interest rate policy may be good for short-term, it can be detrimental to the economy if considered for long-term scenario.

References

Agarwal, R. & Kimball, M., 2022. THE ELECTRONIC MONEY STANDARD AND THE POSSIBILITY OF A ZERO INFLATION TARGET. [Online]

Available at: https://www.imf.org/en/Publications/fandd/issues/2022/03/Future-of-inflation-partIII-Agarwal-kimball

[Accessed 18 Jul 2022].

Altavilla, C., Burlon, L., Giannetti, M. & Holton, S., 2019. The impact of negative interest rates on banks and firms. [Online]

Available at: https://voxeu.org/article/impact-negative-interest-rates-banks-and-firms

[Accessed 18 Jul 2022].

Altavilla, C., Burlon, L., Holton, S. & Giannetti, M., 2022. Is there a zero lower bound? The effects of negative policy rates on banks and firms. Journal of Financial Economics, 144(3), pp. 885-907.

Assenmacher, K. & Krogstrup , S., 2018. Monetary Policy with Negative Interest Rates: Decoupling Cash from Electronic Money. IMF Working Paper.

Beers, B., 2021. Negative Interest Rate. [Online]

Available at: https://www.investopedia.com/terms/n/negative-interest-rate.asp#:~:text=our%20editorial%20policies-,What%20Is%20a%20Negative%20Interest%20Rate%3F,policy%2C%20rather%20than%20crediting%20them.

[Accessed 15 Jul 2022].

Carbó-Valverde, S., Cuadros-Solas, P. J. & Rodríguez-Fernández, F., 2021. The effects of negative interest rates: a literature review and additional evidence on the performance of the European banking sector. The European Journal of Finance, 27(18).

CeliaLópez-Penabad, M., Iglesias-Casal, A. & Neto, J. F.-S., 2022. Effects of a negative interest rate policy in bank profitability and risk taking: Evidence from European banks. Research in International Business and Finance, Volume 60.

Claeys, G., 2021. What Are the Effects of the ECB’s Negative Interest Rate Policy?, s.l.: Policy Department for Economic, Scientific and Quality of Life Policies.

Claeys, G. & Demertzis, M., 2017. How should the European Central Bank ‘normalise’ its monetary policy?. Policy Contribution, Issue 31.

Edey, M., 2009. The Global Financial Crisis and Its Effects. The Economic Society of Australia, 28(3), pp. 186-195.

Friedman, B. M. & Kuttner, K. N., 2010. Implementation of Monetary Policy: How Do Central Banks Set Interest Rates?. In: Handbook of Monetary Economics. s.l.:s.n., pp. 1345-1438.

Hartmann, P. & Smets, F., 2018. The European Central Bank’s Monetary Policy during Its First 20 Years, s.l.: Brookings Papers on Economic Activity.

Investopedia, 2021. How Central Banks Affect Interest Rates. [Online]

Available at: https://www.investopedia.com/ask/answers/031115/how-do-central-banks-impact-interest-rates-economy.asp

[Accessed 18 Jul 2022].

Investopedia, 2021. Monetary Policy. [Online]

Available at: https://www.investopedia.com/terms/m/monetarypolicy.asp

[Accessed 14 Jul 2022].

Jobst, A. & Lin, H., 2016. Negative Interest Rate Policy (NIRP): Implications for Monetary Transmission and Bank Profitability in the Euro Area , s.l.: IMF.

Khoury, S. J. & Pal, P. C., 2020. Negative Interest Rates. Journal of Risk and Financial Management.

Li, Y., Sun, Y. & Chen, M., 2021. An Evaluation of the Impact of Monetary Easing Policies in Times of a Pandemic. Front. Public Health.

Palley, T. I., 2018. The natural interest rate fallacy: why negative interest rate policy may worsen Keynesian unemployment?. Investigacion Economica.

Smith, K. A., 2020. Negative Interest Rates Explained: How Could They Affect You?. [Online]

Available at: https://www.forbes.com/sites/advisor/2020/05/18/negative-interest-rates-explained-how-could-they-affect-you/?sh=65520e7f7b46

[Accessed 13 Jul 2022].

Tokic, D., 2017. Negative interest rates: Causes and consequences. Journal of Asset Management, Volume 18, pp. 243-254.

Verick, S. & Islam, I., 2010. The Great Recession of 2008-2009: Causes, Consequences and Policy Responses. IZA.